The Moneris Go suite: Commerce technology that works for your business

Learn how Moneris Go Terminal and Moneris Go PIN Pad help you accept payments faster, stay secure, and support mobility, fixed checkout, and growth across locations.

Contactless payment for restaurants is no longer optional, it’s an expectation. Customers value speed, security and convenience when paying for their meals and tap-to-pay solutions deliver on all fronts. With tap-enabled debit and credit cards, as well as mobile wallets, restaurants can process transactions in seconds while reducing physical contact.

Beyond convenience, this payment method enhances security through encryption and fraud detection, making it one of the safest ways to complete a purchase. Restaurant owners benefit from shorter wait times, improved service efficiency and increased sales potential. Adopting contactless payments helps businesses meet customer expectations while creating a seamless and trustworthy dining experience.

Contactless payments allow customers to complete transactions by tapping a card, smartphone or wearable device on a payment terminal. This process uses Near Field Communication (NFC) or Radio Frequency Identification (RFID) technology to transmit payment data securely. Below is a breakdown of the key components that make this technology work.

NFC enables wireless communication between a payment terminal and an NFC-enabled device, such as a debit card, credit card or mobile wallet. The technology functions within a short range, typically no more than a few centimetres, to ensure security. When a customer taps their device, the terminal reads the encrypted payment data and initiates the transaction.

To protect sensitive cardholder information, contactless payments use tokenization. Instead of transmitting the actual card number, the system generates a unique token that represents the card details. This token is encrypted and sent for authorization, ensuring that payment information remains secure. Even if intercepted, the token is useless outside that single transaction.

Once the payment terminal receives the encrypted token, it sends the request to the payment processor for authorization. Banks or financial institutions verify the transaction using fraud detection systems and approve or decline the payment in seconds. If additional verification is needed, the customer may be prompted to enter a PIN or complete biometric authentication, depending on the payment method used.

Contactless payment terminals connect directly to a restaurant’s point-of-sale (POS) system. This integration ensures seamless order processing, real-time transaction tracking and accurate sales reporting. Many modern POS systems support multiple payment methods, including chip cards, digital wallets and tap-to-pay options, allowing businesses to cater to a broader customer base.

Mobile payment solutions, such as Android Pay, Apple Pay Google Pay and Samsung Pay, use the same NFC technology as contactless cards. These digital wallets add an extra layer of security by requiring biometric authentication, such as fingerprint or facial recognition, before processing the payment. This feature enhances fraud prevention while providing customers with a fast and hassle-free checkout experience.

Contactless payment for restaurants provides significant advantages for both businesses and customers. A faster checkout process, improved security and better hygiene contribute to an overall smoother dining experience. These benefits make contactless payment solutions an essential feature for modern restaurants.

Restaurants that adopt contactless payment solutions not only improve efficiency but also create a more seamless and secure dining experience for guests. As more customers expect tap-to-pay options like Android Tap to Pay and Apple Tap to Pay. Businesses that implement these solutions stand to gain a strong advantage.

Contactless payment for restaurants offers multiple security layers to protect customer transactions. These advanced security measures help prevent fraud, making tap-to-pay solutions safer than traditional payment methods.

With these security features, contactless payment technology helps restaurants provide a safe and reliable transaction experience for their guests. Reducing fraud risks while maintaining convenience benefits both businesses and customers alike.

Secure payment options play a crucial role in building customer trust, and contactless payments help restaurants create a safe and convenient dining experience. By eliminating the need to hand over a card or touch a keypad, tap-to-pay transactions reduce concerns about card skimming, lost cards and handling cash, giving customers greater control over their payment details. This added security strengthens trust and encourages repeat visits.

Transparency in payment processing further enhances confidence. Digital receipts, instant transaction confirmations, and biometric authentication (such as fingerprint or facial recognition) reassure customers that their payments are protected. Restaurants that adopt secure, efficient and contact-free payment solutions stand out in a competitive market, fostering customer loyalty, positive reviews and long-term relationships.

Implementing contactless payments in restaurants requires careful planning to ensure a smooth transition. Many businesses need to upgrade their payment terminals since older models may not support NFC technology. Investing in modern, contactless-enabled terminals from a compatible payment provider ensures seamless acceptance of tap-to-pay cards and mobile wallets. Additionally, stable internet connectivity is crucial, as contactless transactions rely on real-time processing. Ensuring a reliable network and backup options prevents payment delays and disruptions.

Staff training is another essential step. Employees should be familiar with how contactless payments work, recognize potential issues and assist customers who may be unfamiliar with the technology. Clear signage and customer education can also help ease security concerns and encourage adoption by highlighting the speed and convenience of tap payments. By addressing these challenges early, restaurants can ensure a seamless, secure and efficient contactless payment experience that benefits both customers and staff.

Introducing contactless payments in restaurants begins with selecting an NFC-enabled POS system that supports tap-to-pay cards and mobile wallets. Choosing a payment provider that integrates seamlessly with existing operations simplifies the transition and minimizes disruptions. Employee training is equally important, staff should understand how to process contactless transactions, assist customers with questions and troubleshoot common issues. Clear signage at entry points and checkout counters also helps inform guests that contactless payments are accepted, encouraging adoption by emphasizing speed and security.

Before full implementation, running a pilot phase allows staff to test the system, identify potential issues and ensure smooth operation. Monitoring transaction data and collecting customer feedback help refine the process for maximum efficiency. As more diners expect fast, secure and touch-free payment options, adopting contactless solutions enhances service speed and strengthens customer trust. A well-executed rollout ensures a seamless dining experience while helping restaurants stay competitive.

Seamless payment solutions create better dining experiences. Moneris provides restaurants with secure, reliable and efficient payment options that help businesses serve customers faster and with confidence. With advanced technology and dedicated support, Moneris makes it easier to accept contactless payments and enhance service. Discover how Moneris can help your restaurant provide a smooth and secure checkout experience.

Contactless payment for restaurants speeds up transactions, reducing wait times at checkout or tableside. Customers can tap their card or phone without inserting a chip or entering a PIN, making payments faster and more convenient. This quick and seamless process enhances overall service quality and encourages repeat visits.

Yes, contactless payments use multiple security measures, including tokenization, encryption and fraud monitoring, to protect transactions. Since customers retain control of their cards or mobile devices, the risk of skimming or card theft is significantly reduced. Many banks also offer zero-liability policies, ensuring added protection for consumers.

Most modern POS systems support contactless payment, but older models may require an upgrade to NFC-enabled terminals. Restaurants looking to implement contactless solutions should check with their payment provider to ensure compatibility. Upgrading to an integrated system improves efficiency and allows for seamless transaction processing.

Customers frequently use tap-enabled debit and credit cards, as well as mobile wallets like Apple Pay, Tap to Pay on Android, Google Pay™ and Samsung Pay®. These options offer an extra layer of security with biometric authentication while providing a fast and hassle-free checkout experience. Supporting multiple contactless payment methods helps restaurants accommodate different customer preferences.

Contactless payments streamline service, allowing restaurants to serve more guests in less time. Faster transactions lead to quicker table turnover and greater efficiency, ultimately increasing revenue potential. Additionally, mobile ordering and digital payments make it easier for customers to tip or add extra items to their orders.

Learn how Moneris Go Terminal and Moneris Go PIN Pad help you accept payments faster, stay secure, and support mobility, fixed checkout, and growth across locations.

If you’re ready to turn your passion into profit, here’s what you need to know about starting a side hustle in Canada.

Learn why a POS system is essential for small quick service restaurants and which features help streamline orders, boost sales, and keep your café running smoothly.

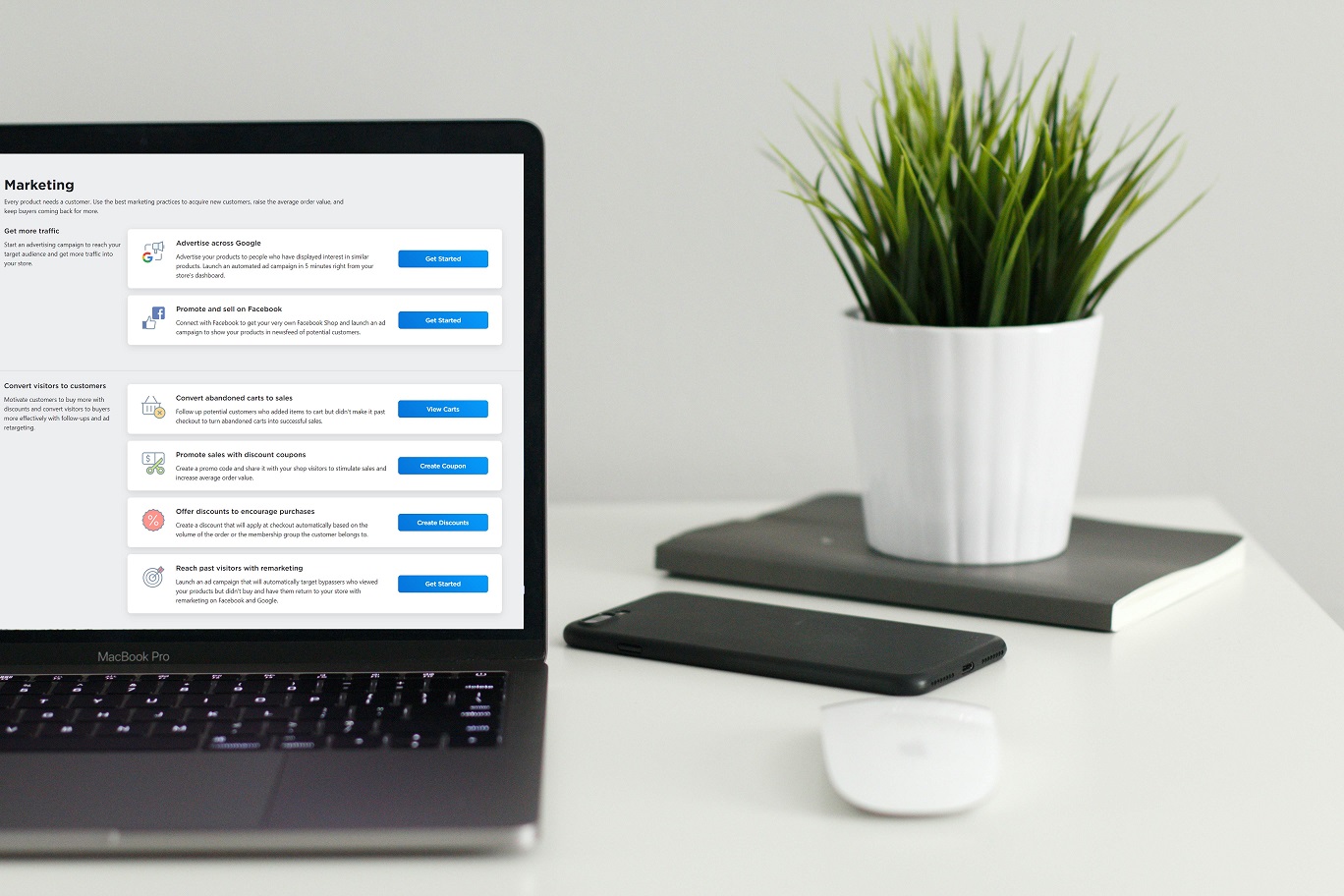

While an optimized ecommerce store is essential for selling your products, you still need a good marketing plan to get your online business off the ground.