Small Business Can't Afford to Ignore Fraud Prevention

Proactive fraud prevention protects revenue, preserves customer trust and keeps payments secure without adding friction to the checkout process.

Read MoreProactive fraud prevention protects revenue, preserves customer trust and keeps payments secure without adding friction to the checkout process.

Read More

Mastercard's complementary Cybersecurity Assessment Tool for small and medium-sized businesses helps you to evaluate your current cybersecurity knowledge and familiarity with best practices, providing you with a report including valuable insights and actionable recommendations to help strengthen your defenses against emerging cyber threats.

Between online, in-store, mail and phone scams, there are several ways fraudsters can target your business. Fret not! We’ve got you. Here are common signs to look out for and some easy steps you can take to prevent fraud on all fronts.

When you create a merchant account with us, we’ll go through a business review and assessment to determine the level of risk in supporting your business.

Now, more than ever, Canadian businesses are adapting, making their products and services available in ways that maintain customer safety, peace-of-mind, and convenience.

The pandemic has forced customers into new buying behaviours, including ecommerce-based contactless delivery methods such as carryout, drive-thru, delivery, and curbside pickup.

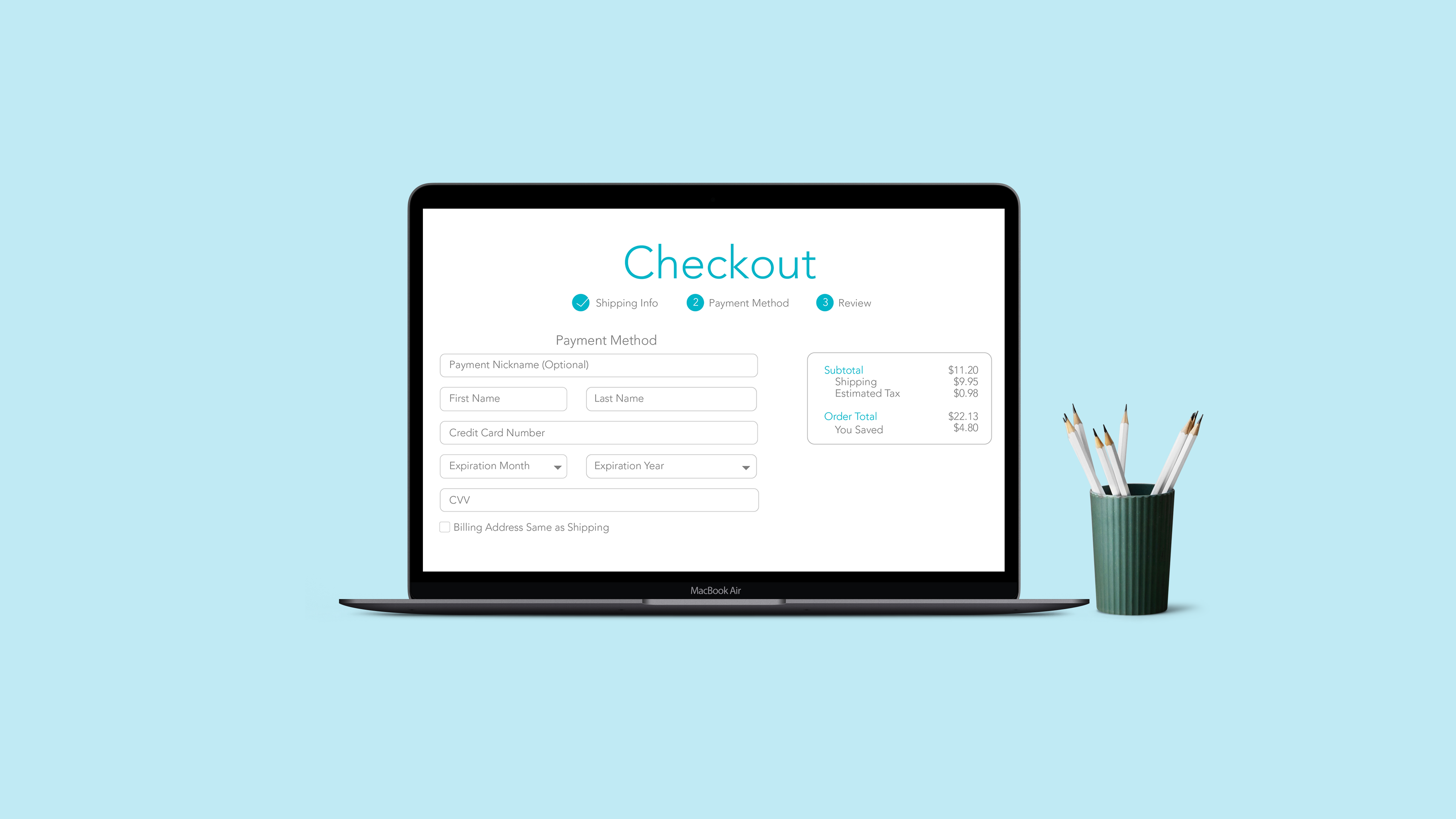

Real-time ecommerce payments can lead to real-time cyber risks.

Keeping a business protected from fraud is similar to keeping it protected from theft – you need to continually check in and audit your practices to make sure you’re doing everything you can.

Does your business have the best tools in place to protect from ecommerce fraud?