Why Modern Payment Solutions Make Sense for Canadian Companies

Like consumers, businesses are pivoting away from traditional payment methods such as cash, cheque and wire transfer to embrace payment solutions that fit their needs.

Read More

Like consumers, businesses are pivoting away from traditional payment methods such as cash, cheque and wire transfer to embrace payment solutions that fit their needs.

Read More

When it comes to payments, suppliers are looking for flexibility and options. Many businesses are stuck using payment solutions like cash, wire transfers or cheques, which have not kept up when it comes to efficiency.

From improved efficiencies and reduced risk to easier access to cash flow, both buyers and suppliers are beginning to understand the benefits of solutions such as ePayables and commercial payment cards.

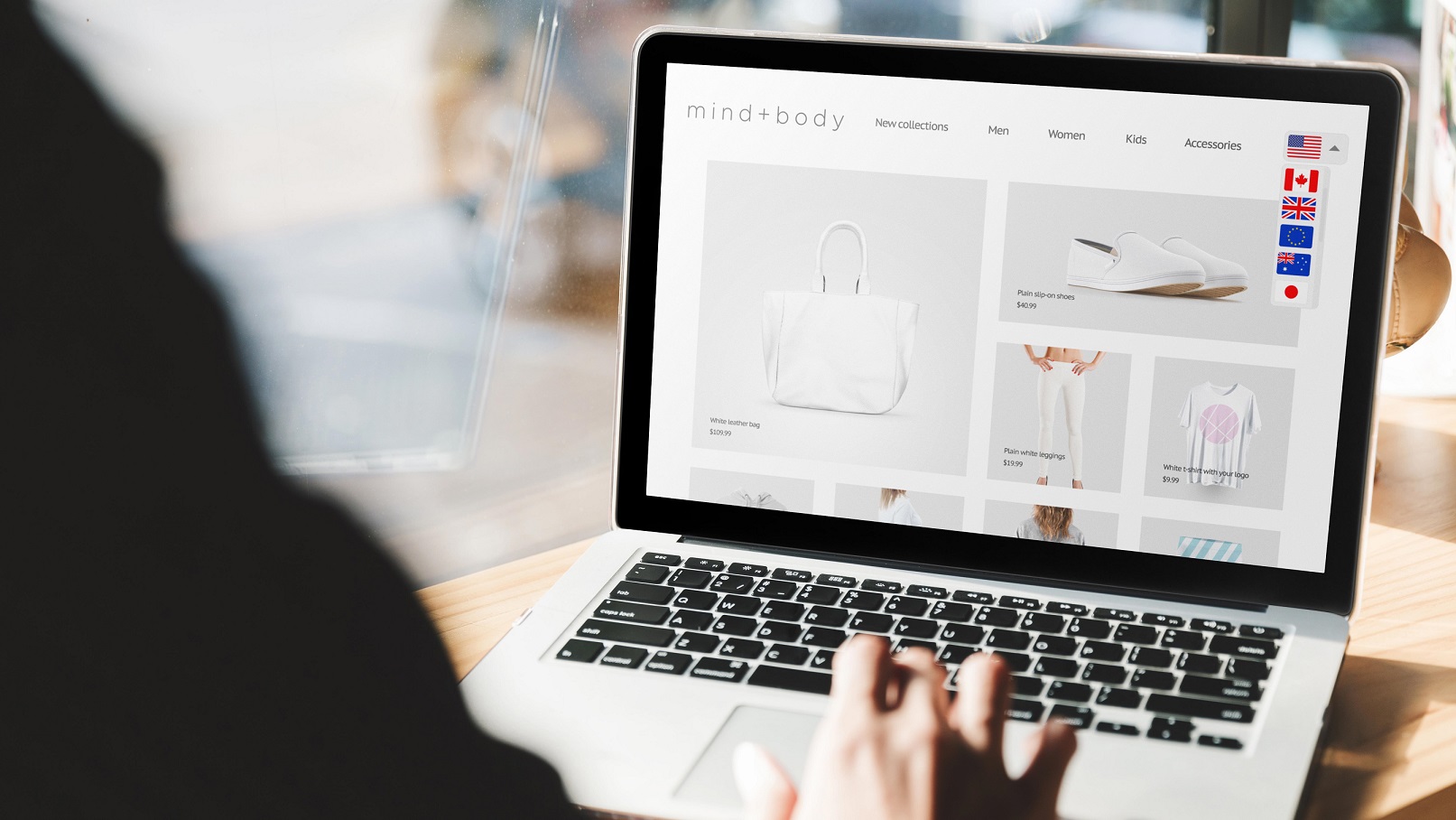

In today’s global economy, business has no borders. Customers – and revenue – can come from anywhere, which opens new doors for both large and small Canadian businesses.

The payments landscape is evolving.