Swipe, tap and thrive: Why every single-location restaurant needs a POS

Learn why a POS system is essential for small quick service restaurants and which features help streamline orders, boost sales, and keep your café running smoothly.

Read MoreLearn why a POS system is essential for small quick service restaurants and which features help streamline orders, boost sales, and keep your café running smoothly.

Read More

Explore how a pharmacy POS system can improve efficiency, customer experience, and inventory management. Find out why Moneris is the ideal choice for your pharmacy.

Explore how a pharmacy POS system can improve efficiency, customer experience, and inventory management. Find out why Moneris is the ideal choice for your pharmacy.

Discover the benefits of streamlined Payment Processing for your business with Moneris.

Discover how Moneris payment terminals can help maximize your profits. Learn about their features, benefits, and how to choose the right one for your business.

Let's discuss the importance of debit terminal security and the key features offered by Moneris to keep your transactions safe and secure, while also providing additional benefits to help you grow and manage your business effectively.

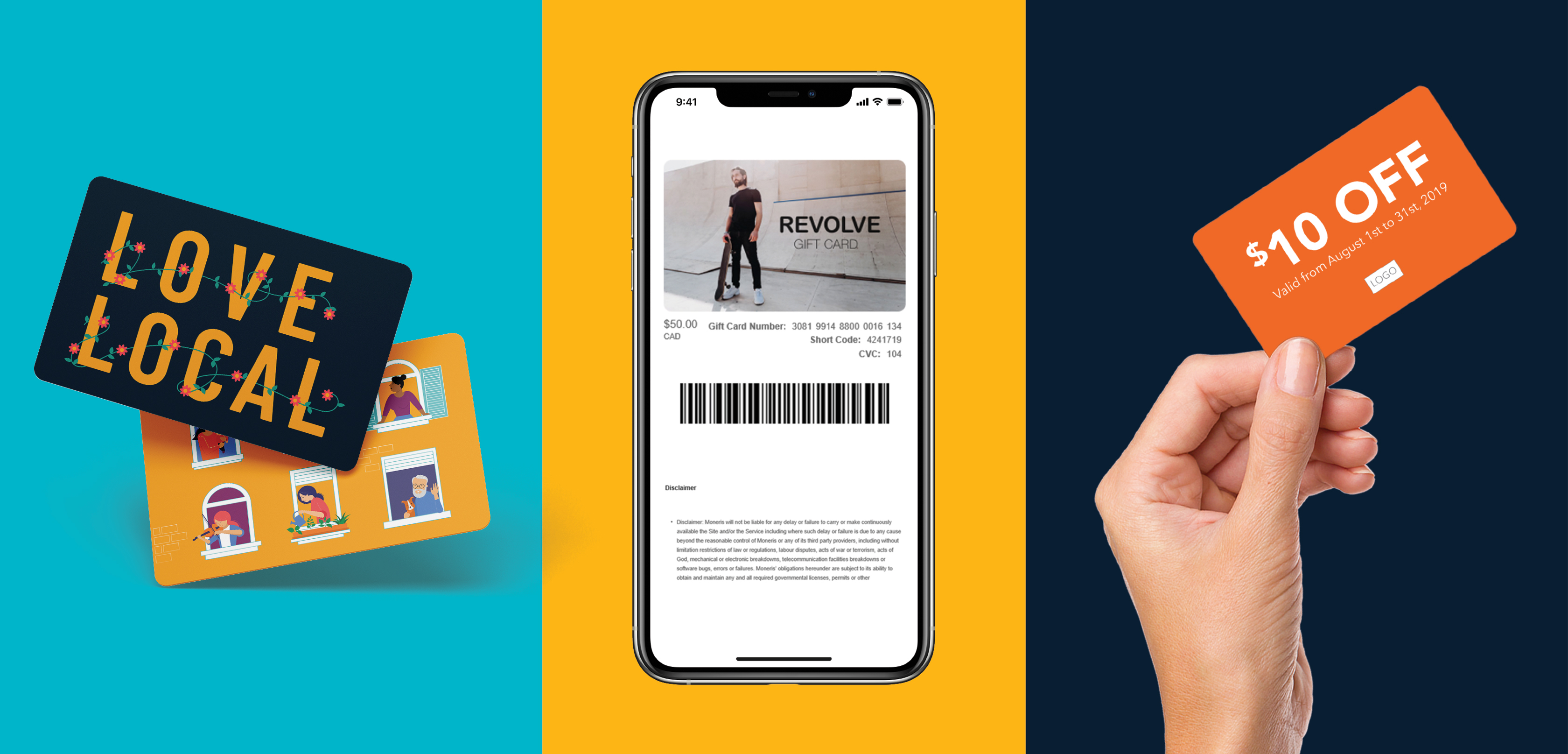

Personalized gift cards are a great way to draw in new customers and introduce them to your brand, products, and services.

Let’s take a look at the benefits of using a debit terminal for small businesses and how Moneris can help small business owners achieve their goals.

In the spirit of the small business month, here are some key benefits of offering gift cards at your small business.

If you own a business, chances are you’ve considered gift cards as a way to add new revenue and provide your customers with a more flexible way to shop. At Moneris, three different gift card options are available for merchants.