What is a Point-of-Sale System? Costs and Features Explained | Understanding POS Systems

A point-of-sale (POS) system is a tool that enables businesses to process sales, track inventory, manage payments and analyze customer transactions.

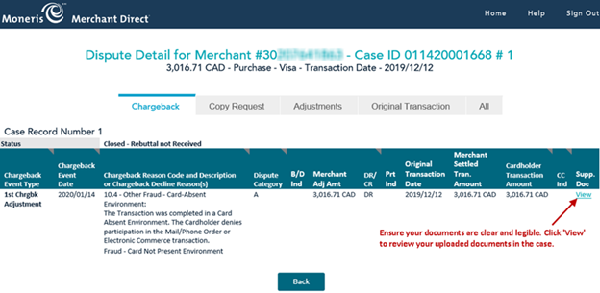

A chargeback can happen to any business that takes card payments and is essentially when authorization may have been provided but is now reversed. It may be caused by cardholder disputes, errors made by businesses in the submission of their credit card transactions or non-authorized transactions. Usually the cardholder contacts their bank, and the issuing bank determines if they have chargeback rights. Typically, they may credit most customers upfront pending the outcome of the case. Then the issuing bank initiates a chargeback (through the card brand association) to Moneris.

As a Moneris merchant there are ways you can manage and dispute chargebacks. Tip: Did you know you can set up a triggered email alert for each chargeback? To view and manage chargebacks, log in to Merchant Direct. Once you log in, you can go to the tab “Disputes” and select which request you need. Also, by looking at the “Outstanding Chargebacks or Outstanding Copy Request Report” you can see the most current and outstanding chargeback requests that need your attention.

If you feel that the purchase was authorized by the cardholder and the sale follows the correct business terms and conditions, then you can dispute a chargeback. Remember to always respond on or before the response due date noted within the case details. If you have the proper documentation and receipts ready, follow these simple steps to dispute the chargeback in Merchant Direct.

If you choose to accept a chargeback case, you are accepting responsibility for the chargeback as the customer will be favored and no further action will be taken in the case. To accept a case, follow these steps:

To learn more about chargebacks, watch our video and see how you can dispute them.

Fraud-related dispute: The merchant processed a transaction that was identified as fraudulent; the cardholder claims that he or she did not authorize or engage in the transaction.

Authorization dispute – The merchant processes a transaction without first obtaining a correct and valid authorization approval from the issuer.

Processing error dispute – Usually starts with the merchant and can be prevented. These chargebacks come from mistakes made by the merchant at some point during the payment submission such as duplicate processing, late presentment when settling the transaction, incorrect amount or account number.

Service dispute – Customers start disputing merchandise or service issues. A few examples would be non-receipt of merchandise/services as agreed, defective merchandise, dissatisfaction with a product, credit not processed.

Overall, chargebacks can affect anyone, and knowing what they are, how they can affect you and your business, and how to respond to them can help avoid lost revenue. If you have a terminal with Moneris, be vigilant for potential red flags – visit our Protecting Against Fraud page for more info.

A point-of-sale (POS) system is a tool that enables businesses to process sales, track inventory, manage payments and analyze customer transactions.

Contactless payment for restaurants offers speed, security and convenience. Learn how tap-to-pay technology improves efficiency and enhances the dining experience.

Learn how to choose the best POS system for your small business. Explore essential features and tips for payment processing and inventory management.

Learn how to process payments online with this comprehensive guide for Canadian businesses. Explore secure, efficient payment processing solutions, and gain insights into integrating and optimizing payment systems to meet customer needs.