Keeping it Simple: Your Payment Processing Costs Explained

pricing, moneris go

Keeping it Simple: Your Payment Processing Costs Explained

August 26, 2024

Calculating time...

Calculating time...

Businesses rely on accepting credit card payments to make sales and earn profits. However, these transactions come with built-in processing fees that are charged to merchants to facilitate the transactions. With debit, credit and increasingly digital wallets being preferred payments for many Canadians, understanding the transaction cost structure can help you choose the most cost-effective payment processing solution for your business.

Types of payment processing costs

Here are the different types of payment processing costs your business might encounter:

Transaction Fees

Transaction fees are at the core of payment processing costs. These fees are charged for each transaction processed through a payment processor or merchant services provider. The exact amount varies based on factors such as the type of transaction (credit card, debit card, online), the payment method used, the volume of transactions, and the pricing structure set by the payment processor.

Interchange Fees

Interchange fees are set by credit card associations (Visa, Mastercard, etc.) and are paid by the merchant's bank to the cardholder's bank for processing transactions. These fees are typically a percentage of the transaction value plus a flat fee. The specific interchange rates vary based on factors such as the type of card (debit, credit, rewards), the transaction type (in-person, online), and the industry.

Monthly Fees

In addition to transaction fees, some payment processors may charge monthly fees for their services. These fees can include account maintenance fees, statement fees, or subscription fees for additional services such as fraud protection or offering advanced reporting features.

Equipment and Setup Costs

If you require physical payment terminals or equipment to process transactions, there may be costs associated with acquiring or leasing them. These costs can include purchase fees, rental fees, or setup fees.

Moneris Flat Rate and Simplified Pricing

Many payment processors offer customized pricing plans to businesses based on transaction volume, business size, industry, or specific requirements. Engaging in discussions with payment processors and negotiating custom pricing options can often lead to more favourable rates and cost savings for your business.

Moneris offers competitive payment processing costs based on two pricing models, depending on the size of your business.

Moneris Flat Rate Pricing

Designed for fast-growing start-ups or small businesses looking for an all-in-one solution at an affordable, fixed monthly rate. Rates are based on a defined percentage and flat rate fee per transaction, so you know exactly what to expect from your payment processing costs. Learn more about Flat Rate pricing here.

Moneris Simplified Pricing

Built for businesses processing large volumes, Simplified pricing allows you to customize your fee structure to find the perfect custom payment processing solution for your business.

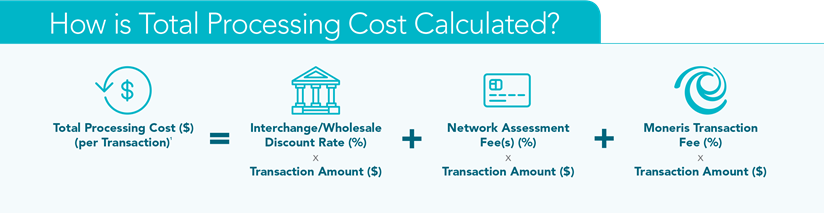

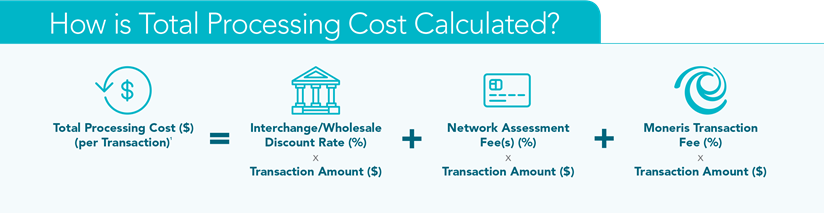

It is based on three primary costs:

- Interchange rates: These are bank fees. It’s the amount that every card processor, like Moneris, is required to pay to credit card issuers and/or financial institutions for each credit or debit card transaction processed by its merchants

- Network assessment fees: These are credit card fees. It’s the amount that every card processor, like Moneris, is required to pay card brands for each credit or debit card transaction processed by its merchants

- Moneris transaction fees: These are the fees we charge to facilitate the transaction processing, clearing, settlement, reporting, and customer service we provide to your business

Note: Effective October 19th, 2024, transactions submitted for clearing and settlement October 18, 2024, will be subject to new interchange rates. Visa and Mastercard will introduce a small merchant interchange rate program that will offer lower rates for domestic consumer credit transactions. To learn more about these interchange rates click here.

How Is the Total Payment Processing Cost Calculated?

Let’s look at how this graphic translates into real-world numbers. Here’s an example of a $100 transaction using a basic (entry-level) Visa card*:

The total processing cost of a $100.00 transaction would be $1.91, which means the business would get $98.09 after processing fees.

To learn more about Simplified Pricing and Moneris fees, click here.

The information in this article is provided solely for informational purposes and is not intended to be legal, business or other professional advice or an endorsement of any of the websites or services listed. VISA is a trademark owned by Visa International Service Association and used under license. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. DISCOVER is a registered trademark of Discover Financial Services.

1The foregoing is an overview of the simplified pricing structure that applies to the processing of credit and debit card transactions. Other fees may apply depending on the services received from Moneris. Please review your Moneris Merchant Agreement for details.

*All rates are dependent on the type of card used. The example shown is for demonstration purposes and does not denote actual rates. Actual rates will vary depending on the merchant agreement and the type of card used.

Author Profile

Moneris Team

Author Profile

Moneris is a leading provider of payment processing solutions in Canada. Our blog is your go-to resource for insights into the ever-evolving world of payments. We cover everything from the latest industry trends and technologies to practical advice for businesses of all sizes. Our blog's mission is to spotlight small businesses and provide resources that help them succeed in today's economy. Blog articles are written by members of Moneris' in-house marketing team with support from internal product and industry experts.