don't need to enter your credit card number every time you shop online. B That's the power of tokenization.

what we’ll cover in this tokenization guide:

-

How does tokenization benefit your small business

-

A deeper look: What is a token?

-

How can Moneris Tokenization help you?

-

Online payments – in-app and websites

-

Seamless omnichannel experience and token management

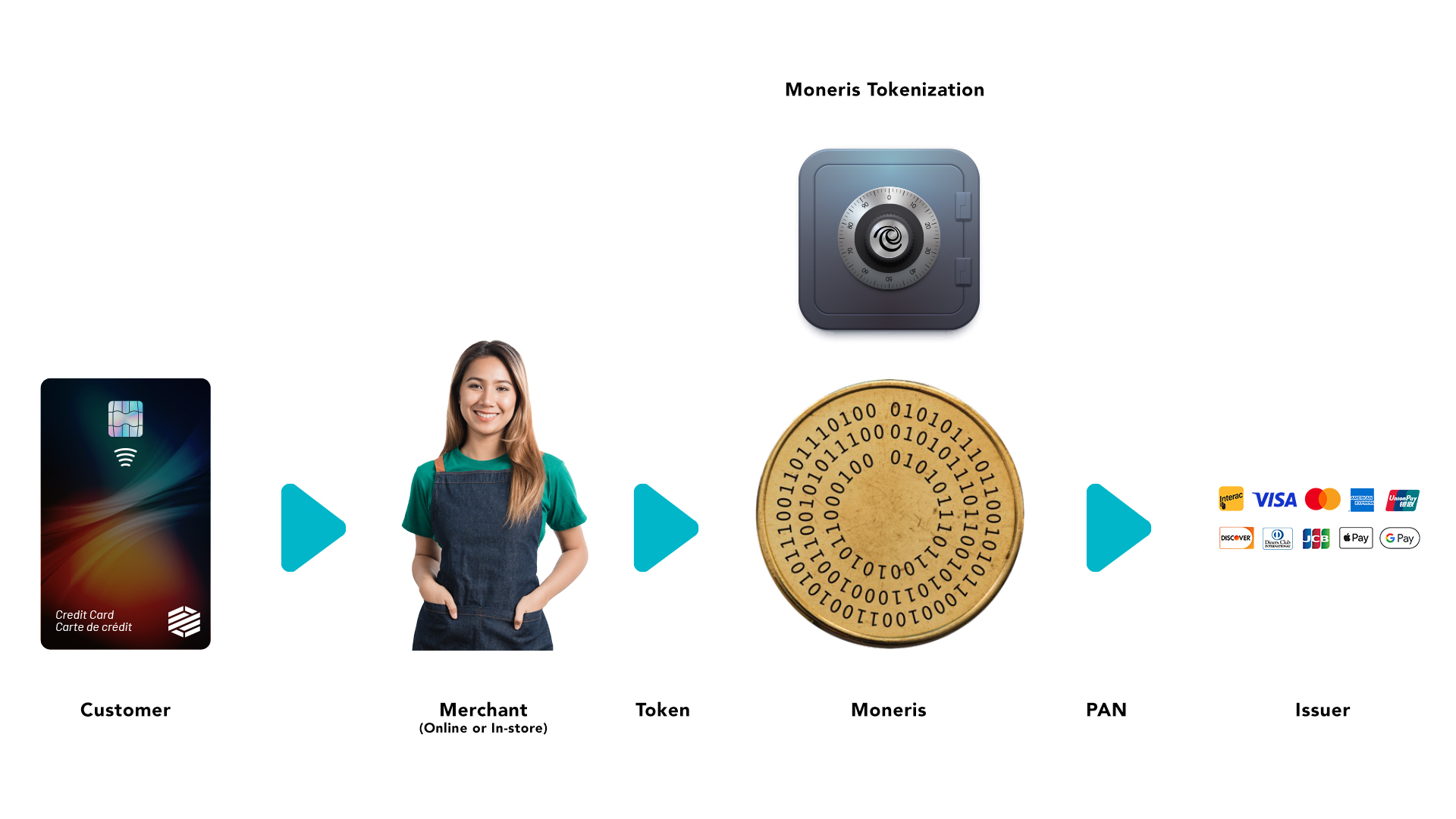

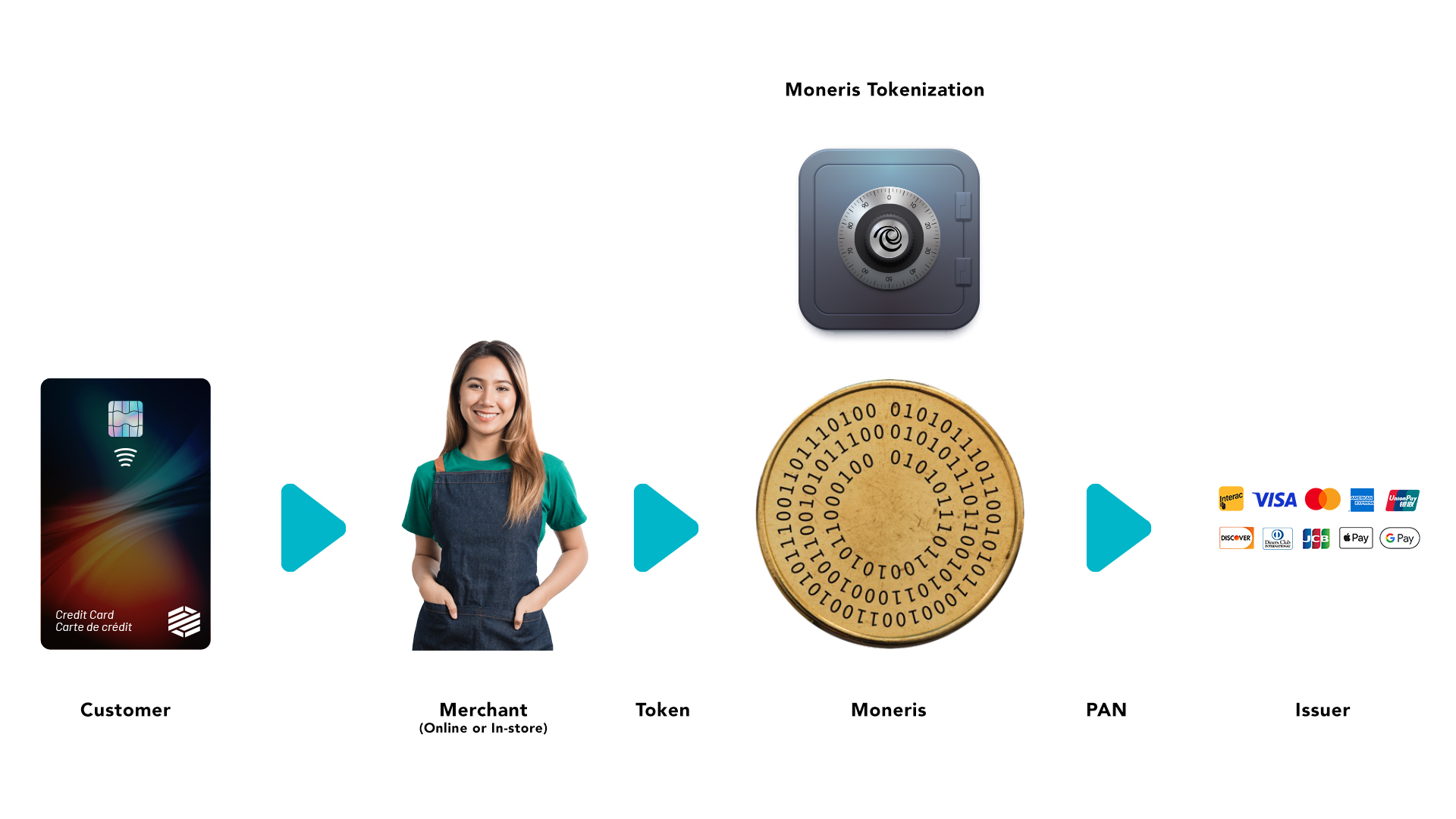

What is tokenization?

Tokenization is a security measure that replaces sensitive card data (like the Primary Account Number, or PAN) with an ncrypted identifier called a token. Think of it like a secret code that unlocks the payment information without ever revealing the actual number.

Payment tokenization is a security practice that protects customers and business owners by encrypting data at the time of transaction.

purchasing tickets for a sports event with your mobile phone. You can use Digital Wallets to do so.

The business owner can store the cardholder's details as a token so that the customer doesn't have to reenter card information every time they want to buy tickets.

How does tokenization help small businesses?

Tokenization is not only a powerful security measure, but it also simplifies compliance, speeds up transactions, reduces fraud, and more.

Here’s how Tokenization

Reduced Risk of Data Breaches: By eliminating the storage of sensitive card data on your servers, a data breach becomes much less impactful. Hackers wouldn't find any credit card information to steal, significantly reducing the damage from a potential attack.

Simplified PCI Compliance: The Payment Card Industry Data Security Standard (PCI DSS) protects cardholders and preserves trust in payments. Tokenization helps by reducing the scope of your PCI compliance, as you won't be dealing with sensitive information directly. Being PCI compliant is a good thing. It is good for the merchant and reduces the risk of incurring penalties.

Faster Checkouts: Customers don't need to manually re-enter their card details for repeat purchases. With tokenization, they can simply choose a saved payment method (token) for a and secure checkout experience, leading to quicker transactions and a smoother shopping experience.

: Customers can easily move between online, mobile, and in-store channels without re-entering payment information, creating a unified and convenient experience.

Reduced Fraud Risk: Tokenization makes it more difficult for fraudsters to use stolen card information, as they wouldn't have access to the actual card number.

Improved Brand Reputation: By prioritizing customer data security, you build trust and project a positive brand image, which can attract new customers and retain existing ones.

P Tokenization can be integrated with loyalty programs, allowing for personalized offers and rewards based on customer purchase history. It drives customer loyalty and repeat business.

A deeper look: What is a token?

To many people, tokens are a type of coin used to play games at an arcade or operate washers and dryers at the Laundromat. In these examples, a token is used instead of the bank issued coin.

A similar concept is used by payment tokenization, except the tokens here are virtual.

How can Moneris Tokenization help you?

Tokens can be created, used, and managed seamlessly across the Moneris ecosystem.

Online payments – in-app and websites

You can use Moneris’ many online solutions, such as our APIs and Hosted Solutions, to enable online payments in your applications and websites. All these solutions support Moneris Tokenization. This enables you to generate tokens from online payments, and use tokens to perform online payments, enabling a seamless and secure online checkout experience.

In-person payments

Moneris Tokenization can be used for in-person payments performed using a Moneris Go Terminal as well. This enables you to generate tokens from transactions performed on a Moneris Go Terminal.

Seamless omnichannel experience and token management

Moneris Tokenization can be used across online and in-person payments. This allows you to generate tokens from in-person transactions and use them for online payments, enabling a true omnichannel experience for your customers. These tokens can be managed using Account Updaters, which automatically update tokens when cardholder account information has changed. This keeps your tokens up-to-date without having to contact your customers.

Ready to get started with tokenization?

whether you’reselling online, in person, both. Our team of experts can help you choose the right option and integrate it seamlessly into your payment process.

o learn about additional security measures that our team is proud to offer merchants, visit our Moneris Go Plus page.

Author Profile

Niyati Budhiraja

Author Profile

Niyati Budhiraja is a word nerd who turns tricky business talk into fun, simple and genuinely helpful content. She writes features on inspiring Canadian businesses, crafts easy-to-follow guides and shares smart tips to help small businesses feel confident and supported. When she’s not writing or dreaming up her next blog idea, you’ll likely find her hunting down the city’s best hot chocolate.