The Moneris Go suite: Commerce technology that works for your business

Learn how Moneris Go Terminal and Moneris Go PIN Pad help you accept payments faster, stay secure, and support mobility, fixed checkout, and growth across locations.

At its core, payment processing is the backbone of commerce in the digital age. It's the journey a payment takes from the moment a customer decides to make a purchase to the point where the transaction is approved, and the funds are transferred to the merchant's account. This process involves several key players: the merchant, the customer, the acquiring bank (merchant's bank), the issuing bank (customer's bank), and the payment processor.

It all begins when a customer swipes, taps, inserts their card, or uses a digital wallet at the point of sale. For online transactions, this process starts when they enter their payment details on a website.

Next, the payment information is sent to the payment processor, which routes it to the relevant card network (Visa, MasterCard, etc.). The card network then forwards the transaction details to the issuing bank for authorization.

The issuing bank performs several checks to authenticate the transaction, including verifying the card's validity, the availability of funds, and any potential for fraud. If everything checks out, the bank sends an authorization code back through the card network to the merchant, indicating the payment can proceed.

Post authorization, the transaction details are sent for settlement. The acquiring bank requests the transfer of funds from the issuing bank, which then transfers the approved amount minus the interchange fees. Once the acquiring bank receives the funds, the transaction is completed, and the merchant receives the payment, minus any fees charged by the acquiring bank and payment processor.

A common concern merchants and consumers have is related to the timing of transactions. Typically, the authorization process is nearly instantaneous, happening within seconds. However, the settlement, where the funds are transferred and available in the merchant's account, can take 1-2 business days. For Discover cards or any specific card network, the timeline can vary slightly but generally falls within the same range.

For many businesses, the thought of switching to a new payment processor or upgrading their point of sale (POS) systems can be fraught with concerns:

A payment processor does more than handle transactions. They are a partner in your business’s operational flow, often offering additional services like analytics, mobile POS systems, and integrated payment solutions that help streamline business operations and enhance the overall customer experience.

Understanding how payment processing works is just the beginning. For businesses looking to enhance their payment systems, considering the speed, security, and reliability of potential solutions is key. With the right partner, you can ensure not only smoother transactions but also a better overall experience for your customers.

Learn how Moneris Go Terminal and Moneris Go PIN Pad help you accept payments faster, stay secure, and support mobility, fixed checkout, and growth across locations.

If you’re ready to turn your passion into profit, here’s what you need to know about starting a side hustle in Canada.

Learn why a POS system is essential for small quick service restaurants and which features help streamline orders, boost sales, and keep your café running smoothly.

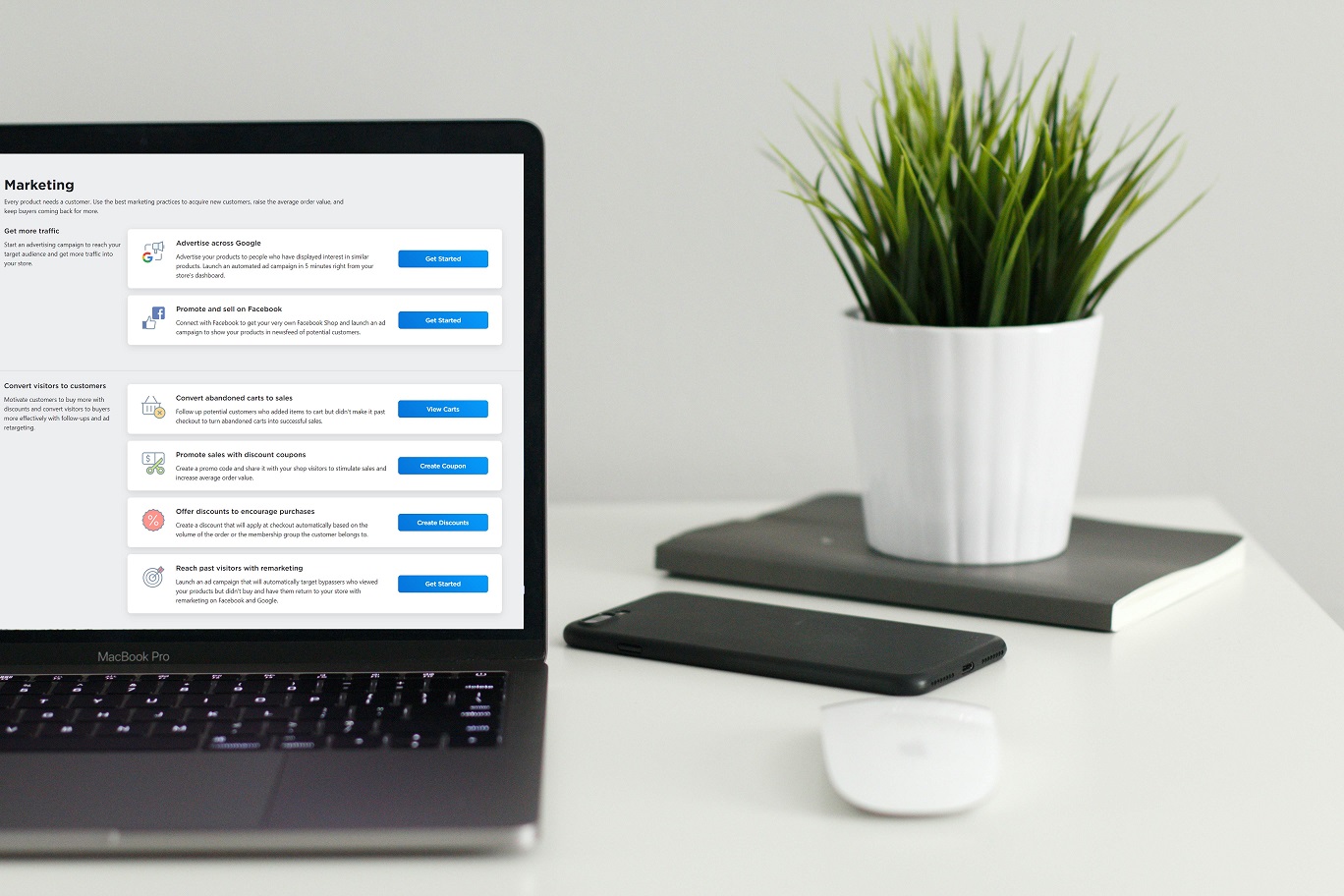

While an optimized ecommerce store is essential for selling your products, you still need a good marketing plan to get your online business off the ground.