Understanding Payment Processing: A Guide

Discover what payment processing is with Moneris. Learn how it empowers businesses and enhances customer transactions. Read more for insights.

Imagine an industry booming and striving uninterruptedly for decades and suddenly coming to a halt. The pandemic impacted all industries hard, but crash landed on the travel industry. Pilots were laid off, airplanes sat parked on tarmacs, hotels sat empty–COVID 19 was more sinister than expected.

Many businesses were forced to reassess their marketing tactics and came up with strategies to shift online to continue to offer a satisfactory shopping experience to their customers. But the tourism industry had no such luck. With travel restrictions in place, the aviation and hospitality sectors bore great losses during COVID.

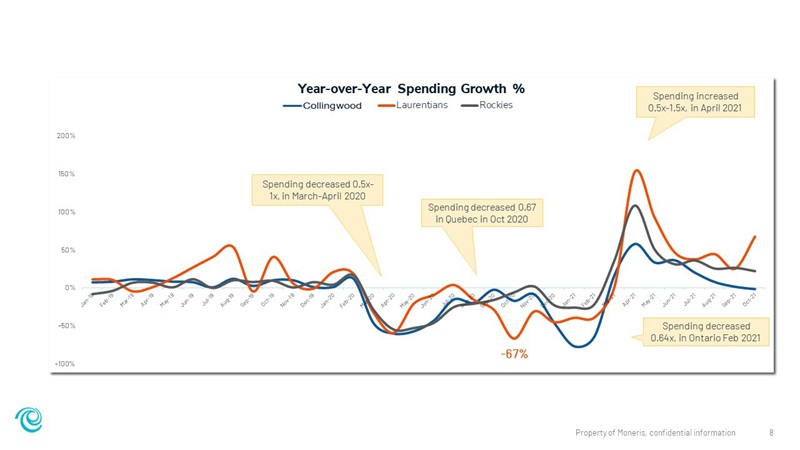

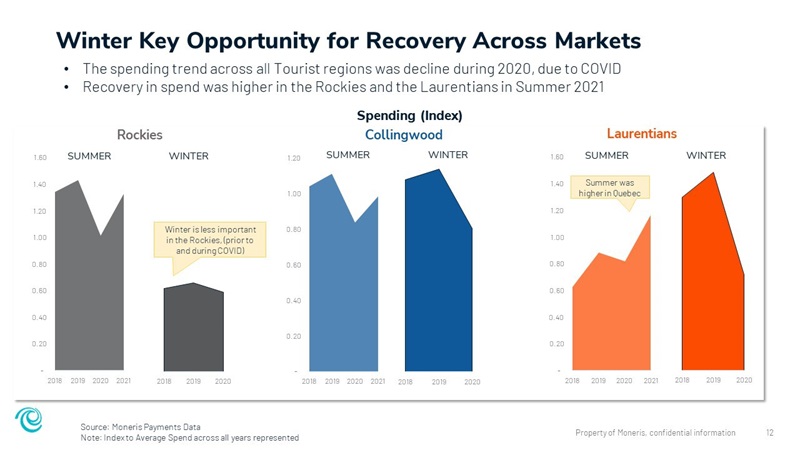

However, with things slowly getting back to normal or adapting to the ‘new normal,’ businesses are picking up pace. To understand consumer spending trends during the pandemic and how they’ve changed with the ease of restrictions, Moneris® Data Services examined tourism and consumer spending trends among Canadians prior-to and during COVID, from January 2019 to December 2021. For this study, a comparison in the consumer buying behavior was done between three mountain destinations–the Rockies, Collingwood, and the Laurentian mountains–popular tourist attractions both in the summer and winter months.

Let’s dive into the key findings of the report.

Gain actionable insights with access to real-time Canadian consumer spending and location data with Moneris Data Services. Learn more.

Mountain destinations in Canada have seen some strong recovery post COVID. As international travel still remains less preferable, domestic Canadian travelers are flocking to local destinations to take a break from work and of course to save themselves the hassle of getting COVID tests done for international travel. While domestic travel has resumed, it can only cover a fragment of losses from overseas tourism. Merchants and tourist destinations should consider driving and attracting continued domestic visitation. However, international spend is still higher (almost double) than domestic and remains a growth opportunity in all markets post-COVID.

Want more data on these travel hotspots? Click here to download the full PDF.

Interested in seeking more consumer behavior insights to help grow your business? Explore Moneris Data Services.

Disclaimer: This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed.

Discover what payment processing is with Moneris. Learn how it empowers businesses and enhances customer transactions. Read more for insights.

This year’s data from Moneris shows how Canadians shopped smarter, seized the moment, and made their holiday dollars count during Black Friday and Cyber Monday

Moneris data reveals that the big concert in Toronto didn’t just captivate audiences—they were a game-changer for the city.

As part of our latest partnership with the Retail Council of Canada (RCC) we are pleased to present this excerpt of their latest retail sentiment report