As part of our latest partnership with the Conference Board of Canada we are pleased to present the following authoritative insights from their Index of Consumer Spending (ICS) which has been Powered by Moneris® Data Services. Our industry-leading consumer spending data and insights from point-of-sale activity combined with The Conference Board of Canada’s expertise provides a coast-to-coast perspective on how the economy is trending.

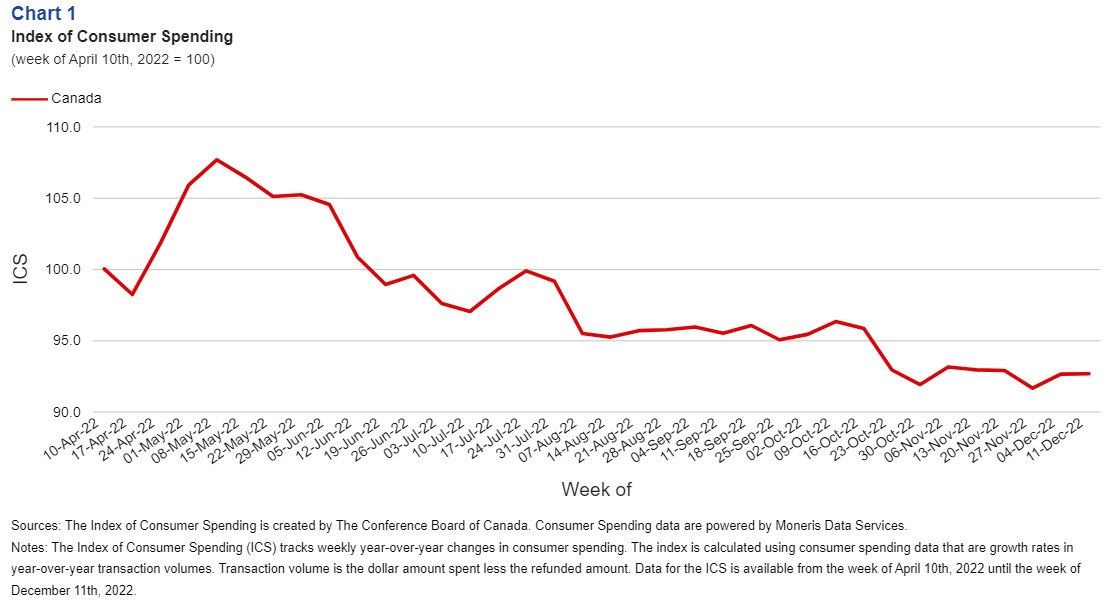

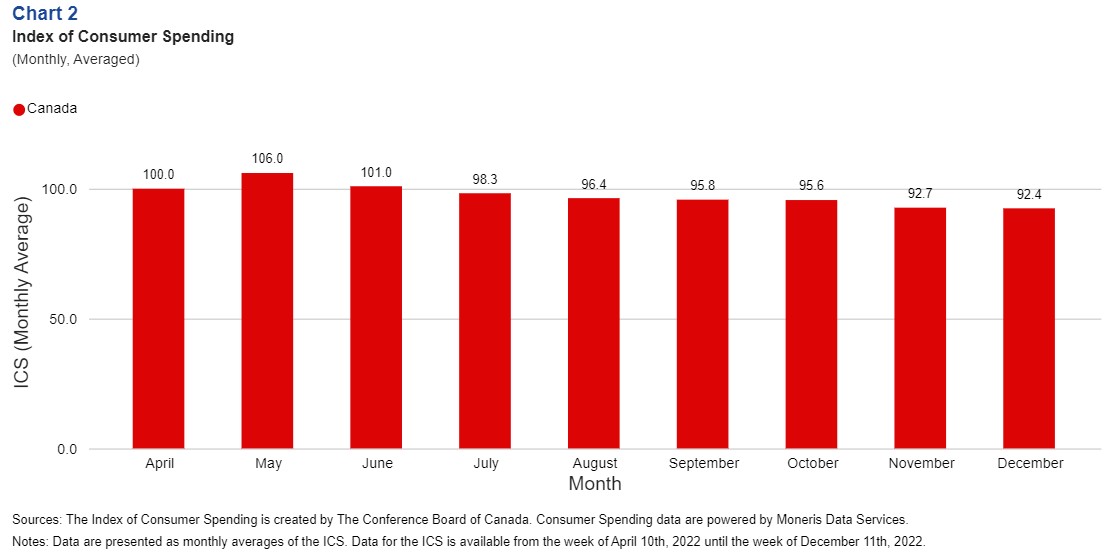

• Growth in consumer spending decelerated further in Q4 of 2022. The Index of Consumer Spending (ICS) averaged 95.6 points in October, 92.7 points in November, and 92.4 points in December.

• Inflation eased to 6.3 per cent (year-over-year) in December but is still well above the target range of 2 to 3 per cent. Households are also concerned about higher food and shelter costs, which has dampened consumers’ outlook on current and future finances.

• The Bank of Canada’s tightening monetary policy has impacted demand for durable goods. However, consumer expenditures on high-contact services remained resilient.

• Canada’s labour market performed well in Q4 of 2022, with the national unemployment rate averaging 5.2 per cent. Growth in consumer spending would have been weaker had labour markets not been so tight.

Gain actionable insights with access to real-time Canadian consumer spending and location data with Moneris Data Services. Learn more.

Key Insights

Persistent inflation and higher interest rates have impacted how Canadians feel about their financial situations.

The Bank of Canada’s tightening monetary policy seems to be working – headline inflation is slowly falling. However, despite this decline, food costs remain high, and this is a concern for households. In Q4 of 2022, food inflation hovered above 10 per cent, resulting in a change in customer behaviour. Consumers had to alter their budgets to cope with elevated food prices. Canadians are also facing higher interest rates. As a result, the cost of borrowing has increased, and demand for durables has declined. Higher interest rates, coupled with elevated food costs, have caused households to feel less confident about their financial situations, resulting in decelerated growth in consumer spending.

It is not all doom and gloom – the labour market continues to be a bright spot for the economy.

Canada’s labour market ended the year on a high note, as employment levels rose by 69,000 jobs in December. Even though there was a decline in demand for durable goods, expenditures on services were resilient – thanks to the strong labour market. Growth in consumer spending would have dampened further had labour markets not been tight. We expect that there will be a slight uptick in the national unemployment rate in the coming months as the economy slows. However, Canadians have accumulated massive amounts of excess savings over the last two years, which could help consumers weather any storm that may arise over the next year.

With the economy expected to lose steam in 2023, growth in consumer spending will likely decelerate further.

It takes several months for the full impact of changes in monetary policy to be felt throughout the economy. The Bank of Canada raised interest rates seven times in 2022 and once so far this year. The Bank will assess the state of the economy and the pace at which inflation is falling before they consider another change in the overnight rate. We expect economic activity to cool this year as recent rate hikes work their way through the economy. As a result, households will look to spend less, especially on big-ticket items and durables.

About The Conference Board of Canada:

The Conference Board of Canada is the country’s leading independent research organization. Our mission is to empower and inspire leaders to build a stronger future for all Canadians through our trusted research and unparalleled connections. Index of Consumer Spending | The Conference Board of Canada.

Media Contacts:

The Conference Board of Canada

[email protected] / 613-526-3090 ext. 224

[email protected] / 416-734-1442

David Ristovski

Economist

[email protected]

Share