Moneris Kount® Essential is an advanced fraud protection platform designed for small businesses looking to reduce exposure to fraud and assess customers in real-time.--

With user penetration in ecommerce inching close to 76.5% in 2023 and expected to hit 79.4% by 2027, it's essential to develop a fraud prevention strategy for your online business. Unlike traditional brick-and-mortar stores, detecting fraudulent behaviour can be difficult and leave your online store vulnerable to fraud if you're not careful.

Whether it's a single chargeback or a stream of small fraudulent purchases, it can take a significant toll on your small business. That's why Moneris offers a range of online fraud protection tools for businesses of all sizes. Moneris Checkout which offers a fully hosted payment solution and Moneris API which lets your developers integrate payment processing directly into your existing website are both compatible with our fraud tools so you have the ability to take advantage of Kount Essential for your ecommerce business

Types of ecommerce fraud

Payments processed online, also known as card-not-present transactions, are part of the growing share of fraud reported each year. These cases can involve identity theft fraud or interception fraud, where fraudsters make purchases by using stolen credit cards. In both cases, the legitimate cardholder will contact their card issuer to dispute the fraudulent transaction, which may result in a chargeback.

The cardholders themselves can also perpetrate chargeback fraud, where they will make purchases online to claim fraud afterward. If the merchant is unable to prove that the cardholder authorized the transaction, the cardholder gets a full refund and retains the bought goods, while the merchant suffers a loss.

The use of stolen credit card information, identity theft, and chargeback fraud are just a small number of schemes that fraudsters use online. Luckily, there are many recommended tactics to help detect cases of online fraud before they result in lost sales for your ecommerce business.

How to prevent ecommerce fraud

Knowing your customer’s habits

- Understanding the general habits and shopping patterns of your customers can help identify irregular activities, such as:

- A purchase that's unusually large compared to the average cost of your order

- Bulk orders of the same item

- Large ticket items, like electronics, that can be sold for cash profit

- Multiple transactions over a short period

- Multiple transactions on one card with different shipping addresses

Consider setting limits

A common tactic among fraudsters is to max out a stolen credit card by using it to make high-value purchases. Setting restrictions on the total purchase amount may be a simple solution for your ecommerce business. Based on your average order value and revenue trends, set limits for the number of purchases and total dollar value you'll accept from one account in a single day.

Enable standard ecommerce fraud prevention tools

You don't need to be a massive online retailer to enable some of the fraud prevention tools on your ecommerce site. These features are the easiest way to minimize your exposure to online fraud:

CVV (Card Verification Value)

CVV – a 3-4 digit code that verifies the purchaser has the card in their possession – is mandatory for online processing and acts as another tool to help prevent fraud. On Visa and Mastercard, this number is on the back, and with American Express cards, this number is on the front. Fraudsters may not be able to steal both the credit card number and the corresponding CVV, so this option can deter them from using your site.

AVS (Address Verification Service)

Address Verification Service, or AVS, asks that cardholders input their billing address linked to the card before completing the purchase. In the back-end, the card issuer is cross-referencing the address with the customer's details on file. If the address matches, there's less risk that the purchase is coming from a stolen card.

Real-Time Cardholder Authentication

3-D Secure provides real-time authentication of an online shopper to their card issuer through Visa® Secure, MasterCard Identity Check®, and American Express SafeKey®. 3DS uses risk assessment technology to authenticate the cardholder in the background, and only challenges cardholders to enter a one-time passcode if they have a higher risk profile. The additional security layer helps prevent unauthorized card-not-present transactions and protects your business from fraud.

Update your ecommerce solution

With 75% of Canadians shopping online, having a seamless ecommerce experience is critically important for success. While having a mobile-friendly website is a big part of it, you also have to offer a seamless checkout experience. To meet the changing preferences of consumers, upgrading to a modern ecommerce solution can provide a better shopping experience for your customers while protecting your business from fraud.

Take the effort out of checkout

Moneris Checkout is a comprehensive, hosted payment solution that allows you to accept online payments securely. It features a ready-to-use checkout page with customizable features, built-in support for fraud prevention tools, and accepts all major credit cards, digital wallet payments and gift cards. Along with being PCI compliant, our additional fraud-protection features like Moneris Kount Essential, add security protocols to the payment stage to help you prevent chargebacks.

Manage your risk with Moneris Kount Essential

Kount, a Moneris partner, helps ecommerce businesses boost sales by reducing fraud and allowing you to accept more orders from more people in more places than ever before. Moneris collaborated with Kount to expand fraud protection services to small businesses by building an easy-to-use fraud solution that reduces chargeback risks from online transactions.

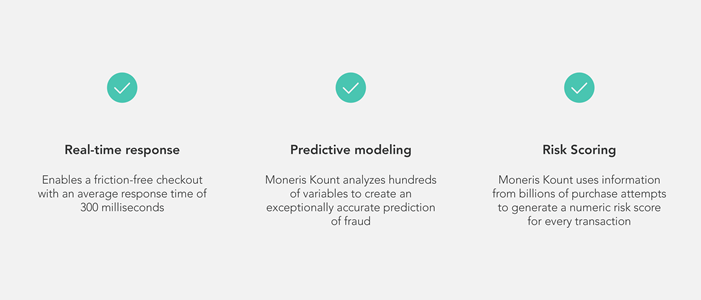

With Moneris Kount Essential, you can get out-of-the-box fraud protection for your ecommerce business. It uses predetermined risk parameters based on your business size and industry to assess potentially fraudulent transactions in real-time. The features include:

With our layered approach to fraud prevention, you can incorporate Moneris Kount Essential with other tools, such as AVS, CVV, 3D Secure and transaction amount limits. Moneris Checkout also offers an auto-decision tool, prevents suspicious transactions from processing, based on the results from Moneris Kount, 3D Secure, AVS and CVV.

Protect your ecommerce business against fraud

Without an online fraud prevention strategy, your business can become a target. With Moneris' range of fraud protection tools and partnership with Kount, you can protect your business with real-time solutions that reduce chargeback and minimize losses.

The information in this article is provided solely for informational purposes and is not intended to be legal, business or other professional advice or an endorsement of any of the websites or services listed.

Share